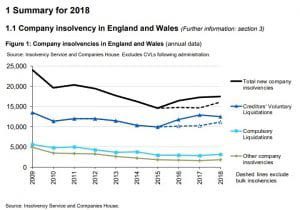

The Insolvency Service has released the Oct-Dec 2018 Insolvency Statistics which showed corporate insolvencies are still on the increase with a small rise of 0.7%, they are now at the highest level seen since 2014 with a total of 16,090 companies being made insolvent.

Worryingly for the economy the sector with the highest number of company insolvencies were in the construction sector which saw 2,954 insolvencies. We anticipate this may increase further over Q1 2019.

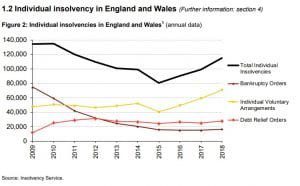

But it is the personal insolvency rises which has caused the most alarm, with an increase to levels not seen since 2011 with a total of 115,299 being declared bankrupt a 16.2% increase.

The corporate figures represents 1 in everyone 249 companies being liquidated. If you are a director and your business is struggling early intervention by an Insolvency expert such as ourselves can help preserve the business and obtain the best results for directors, staff and creditors. Call us today.

Dated: 4 August 2020

*Nothing in this article constitutes legal advice or gives rise to an advisor/client relationship. Specialist legal advice should be taken in relation to your specific circumstances. This article is provided for general information purposes only. Whilst we endeavor to ensure that the information is correct, no warranty, express or implied, is given as to its accuracy and we do not accept any liability for error or omission as it is based upon our interpretation of the law. Please be aware that the legal circumstances may have changed since this article was first published in August 2020 and you should contact us for specific up to date advice on your circumstances.